Electric Car Benefit in Kind (BIK): The Ultimate Guide

Once upon a time, electric company cars were blissfully exempt from benefit-in-kind tax. Just like road tax. But, as the number of electric vehicles (EVs) surges (1,850,000 to date), the rules of BIK for electric cars, unfortunately, have changed.

Tax, after all, is inescapable.

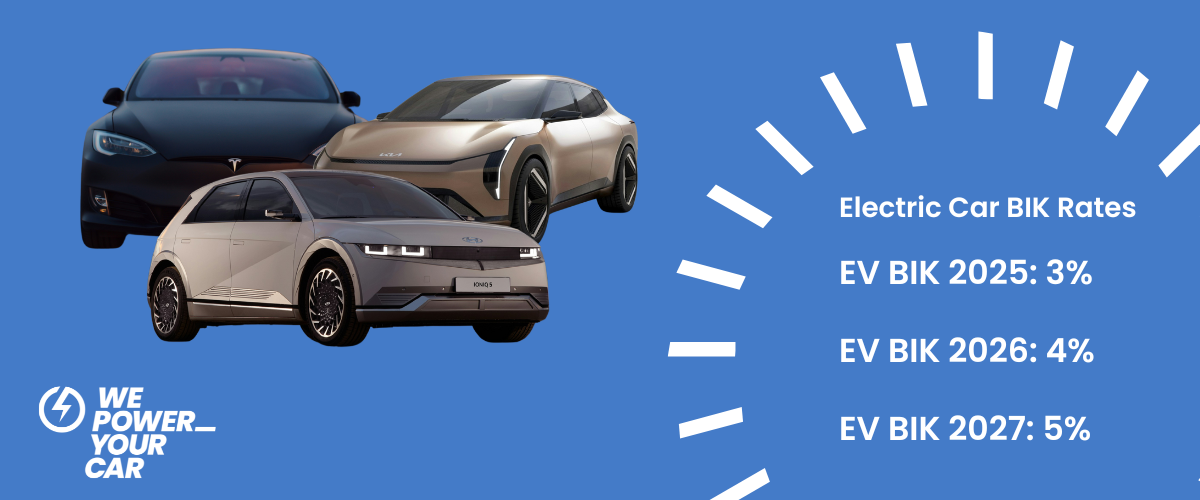

That said, electric cars still enjoy the lowest BIK rates in 2025/2026 at 3%, making them an attractive option for both employers and employees alike.

In our guide, we dive into the topic of benefit-in-kind tax. While we give a holistic view on the rates, the rest of the article is centred specifically through the lens of electric cars.

Without further ado, let’s get into benefit in kind tax on electric cars.

Summary:

- The HMRC electric car benefit-in-kind rate for April 2025 is 3%. The EV BIK rate will then annually increase: 4% in 2026, 5% in 2027, and so on until it reaches 9% in 2030 in the UK.

- EV benefit-in-kind tax, or company car tax on electric cars, is significantly cheaper than BIK for petrol and diesel vehicles. To date, the BIK rate for electric cars is 3% against 13% for hybrid cars and 37% for ICE vehicles (petrol and diesel cars).

- Employers still have to pay national insurance.

- Last year, the EV BIK rate was 2%. Now, though, it has gone up to 3%.

- To calculate BIK tax, use your P11D Value, your car’s CO2 emissions and your income tax.

What is benefit in kind (BIK) tax?

In layman’s terms, benefit-in-kind tax (BIK) is imposed when employees enjoy an additional perk on top of their everyday job and standard salary.

Commonly, company cars are what immediately come to mind, which is why BIK can also be called company car tax. However, other benefits do exist. Phone contracts, gym memberships, and private healthcare are all classified as BIK.

It’s good to note that some benefit-in-kind options, though, are tax-free. Childcare and cycle-to-work schemes are some examples.

How do I pay benefit in kind tax?

Each month, a portion of your salary (pre-tax) goes toward paying the benefit in kind tax through Pay As You Earn (PAYE). You’re not alone, though. Your employer will pay out on your company car on a monthly basis, too.

How does benefit-in-kind tax work?

Different cars have different BIK percentage brackets, meaning benefit-in-kind tax is not the same for everyone. In fact, three elements are important when calculating your benefit-in-kind tax. One, your car’s CO2 emissions and two, your car’s P11D value. The third and final is your employee tax band.

CO2 figures are based on the Worldwide Harmonised Light Vehicles Test Procedure (WLTP).

What is a P11D?

A P11D is a form you complete for HMRC that reports on any employee benefits. In this form, you have to include specific details about your company car, including price, delivery costs, any additional extras added to the car, and finally, VAT.

How do I calculate the benefit-in-kind tax on my electric car?

Use the following formula to work out your benefit-in-kind tax amount:

P11D value x EV BiK Rate x Income Tax Rate

Still struggling? Use HMRC’s tool to calculate the rate in seconds.

What are the current electric car benefit in kind (BiK) rates?

Below are the current (2026) and future BIK rates, or company car tax rates, as set by HMRC.

CO2 (g/km) |

Electric range (miles) |

BiK Rates |

||||

| 2025/26 | 2026/27 | 2027/28 | 2028/29 | 2029/30 | ||

| 0 | 3% | 4% | 5% | 7% | 9% | |

| 1-50 | >130 | 3% | 4% | 5% | 18% | 19% |

| 1-50 | 70-129 | 6% | 7% | 8% | 18% | 19% |

| 1-50 | 40-69 | 9% | 10% | 11% | 18% | 19% |

| 1-50 | 30-39 | 13% | 14% | 15% | 18% | 19% |

| 1-50 | <30 | 15% | 16% | 17% | 18% | 19% |

| 51-54 | 16% | 17% | 18% | 19% | 20% | |

| 55-59 | 17% | 18% | 19% | 20% | 21% | |

| 60-64 | 18% | 19% | 20% | 21% | 22% | |

| 65-69 | 19% | 20% | 21% | 22% | 23% | |

| 70-74 | 20% | 21% | 22% | 23% | 24% | |

| 75-79 | 21% | 21% | 21% | 22% | 23% | |

| 80-84 | 22% | 22% | 22% | 23% | 24% | |

| 85-89 | 23% | 23% | 23% | 24% | 25% | |

| 90-94 | 24% | 24% | 24% | 25% | 26% | |

| 95-99 | 25% | 25% | 25% | 26% | 27% | |

| 100-104 | 26% | 26% | 26% | 27% | 28% | |

| 105-109 | 27% | 27% | 27% | 28% | 29% | |

| 110-114 | 28% | 28% | 28% | 29% | 30% | |

| 115-119 | 29% | 29% | 29% | 30% | 31% | |

| 120-124 | 30% | 30% | 30% | 31% | 32% | |

| 125-129 | 31% | 31% | 31% | 32% | 33% | |

| 130-134 | 32% | 32% | 32% | 33% | 34% | |

| 135-139 | 33% | 33% | 33% | 34% | 35% | |

| 140-144 | 34% | 34% | 34% | 35% | 36% | |

| 145-149 | 35% | 35% | 35% | 36% | 37% | |

| 150-154 | 36% | 36% | 36% | 37% | 38% | |

| 155-159 | 37% | 37% | 37% | 38% | 39% | |

| 160-164 | 37% | 37% | 37% | 38% | 39% | |

| 165-169 | 37% | 37% | 37% | 38% | 39% | |

| 170+ | 37% | 37% | 37% | 38% | 39% | |

Calculated example of electric car benefit in kind tax:

Below is an example of benefit in kind tax for an electric car, based on an assumed P11D Value of £33,000.

Using the table of BIK rates above, as a battery electric car with no emissions and a range above 130 miles, the BIK tax rate will be 3% in 2025.

The BiK Value for our example electric car in 2025 will be £33,000 x 3% = £990

The BiK value for an ICE vehicle would be £33,000 x 37% = £1,221,000

To get the amount your company car will cost you in tax per year, you simply multiply the BiK value by your income tax bracket. Here are the examples using the income tax banding for 20-45%:

£990 x 20% = £198.00 per year / £16.50 per month

£990 x 40% = £396.00 per year / £33.00 per month

£990 x 45% = £445.50 per year / £37.12 per month

Why is the benefit in kind tax lower for electric cars?

Simply put, benefit-in-kind tax is lower for electric cars in an effort to boost EV adoption and improve the linear journey to decarbonisation. The UK government’s goal is to be net-zero by 2050, so significantly lower electric car BIK rates are another incentive to get people to make the switch to electric.

Benefit in kind tax on electric cars: Why should you care?

Employees pay less benefit in kind tax on electric cars. It’s as simple as that. Specifically, benefit-in-kind tax is the cheapest for fully electric cars, currently sitting snug at 3%. In comparison, fossil fuel BIK tax is 37%, at a minimum.

Pushing the cheaper tax rate for electric cars from your mind, you also remove one of the biggest barriers to EV adoption. Price. With high price tags, electric cars, in truth, are not universally accessible. But by driving an electric car through a company car scheme (or salary sacrifice scheme), you get the privilege of an electric car – and the numerous benefits EVs bring – without the upfront cost.

Further to this, company car drivers can benefit from lower everyday costs. With a home EV charger, you can charge your car for as little as 7p per kWh during off-peak hours. And in some cases, your employers may offer free EV charging at your office, too.

Take charge with a dedicated smart charge point.

Start saving on electric car charging costs with a smart EV charger. In fact, did you know you can charge for as little as 5p, according to the AA?

Trust We Power Your Car for your charging point supply and installation. With close partnerships with leading EV charger manufacturers, we provide a wide range of the UK’s market-leading 7kW smart EV chargers. Plus, we provide expert, accredited and experienced EV charger installation from our DBS-checked engineers across the UK. So sit back and relax as we manage the complex process on your behalf. That’s including DNO notification and grant paperwork, too.

If you’re ready to get an EV charger installed, click below to get your fast, free quote, or contact us with any questions. Our experts only provide unbiased advice.

Struggling to decide on a smart charger? Check out our guide to the best home EV chargers in the UK to find the right one for you.